“The Customer is Always Right” ~ Just Look at the Numbers

By ELLEN LEWIS

“The customer is always right”. This slogan has been the driving force behind good retailing since commerce began. Back in the 70’s, at the onset of my career with Federated Department stores, it meant, primarily, take back anything the customer tries to return, no matter how noxious. Today, responding to the customer, requires a much greater focus, a deep dive into analytics that scan the globe for validation. This is the lifeblood of The NPD Group, who hunt and gather consumer purchasing statistics to help the industry clarify customer desire.

Pre-Covid 19, I coordinated with my NPD colleagues to spearhead an article about the evolution of Lingerie spending, not only what but also by whom. Todd Mick, Executive Director at NPD told me: “On-line access has given the consumer more shopping choices resulting in more control on company behavior.” Covid 19 has only served to amplify this message, but the information was brewing long before life turned upside down.

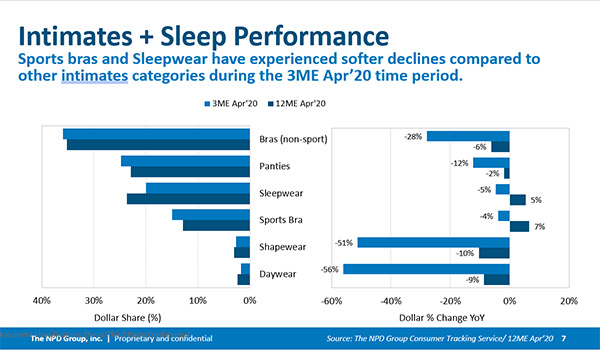

The emphasis on comfort, wardrobe blending, sustainability and well-being had already begun to translate to increased purchases of loungewear, activewear, wire-free, and sports bras. Todd explains “The consumer craves comfort categories like Wire Free and Sports Bras; with Wire Free becoming 34% of total Bra sales up 3% from 2018….and Sports Bras growing by 7%”. An increased fixation on exercise and above the waist dressing, now a standard dress code for web-based communication, only serves to escalate this surge. Sleepwear, inclusive of the 24/7 crossover loungewear phenomenon has realized 10% growth over the past 2 years. Cocooning has certainly contributed to this lifestyle trend. Now, immersed in Covid 19 restrictions, much of life’s entertainment is sourced at home virtually or in seductive privacy.

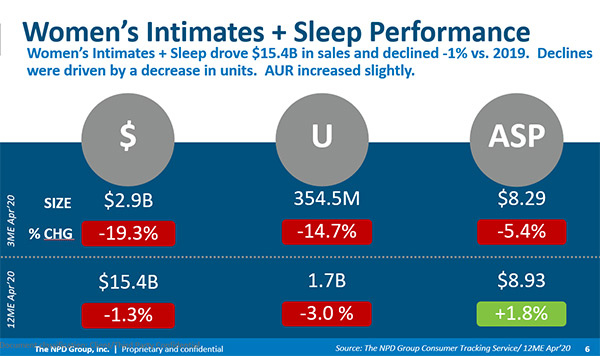

It is interesting to note that the $15.4 billion intimate apparel business in the USA decreased by a mere 1% from April 2019 to April 2020. This included the first quarter sales drop in 2020 (Covid influenced) of 19.3%. Translation, Intimates, powered by the above categories are healthy. This is confirmed by many of my conversations with retailers across the country who are experiencing positive results as they emerge from store closure. Add to this that the average unit sale is rising. Focus on sustainability may have yielded to survival, but the concept of investing in quality for longevity is apparent

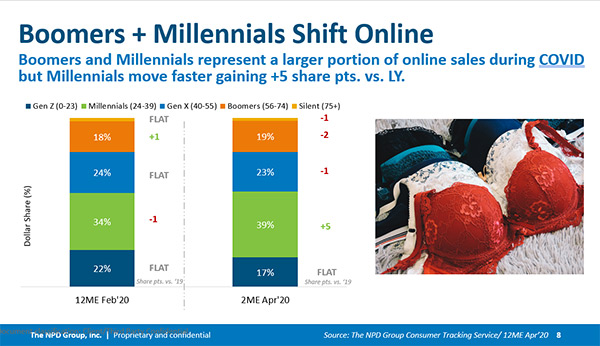

The other interesting consumer insight has been the shift in emphasis beyond the Millennial and Gen Z market. The Boomer segment representing 18% of the entire intimate’s market, grew by 2% over the past 2 years. Even as Millennials and Gen Z account for 55% of online sales, Boomers, during Covid 19, have increased their on-line presence by 1% as they have become more comfortable buying online. Generally, more attracted to the brick and mortar experience, retailers and brands who acknowledge this customer, in store and on-line, are winning. This is a consumer whose pocketbooks might be more plentiful. This market is a niche whose impact should not be ignored.

The lessons emanating from the past year, including the upheaval of an unprecedented retail shutdown are many. But one thing for sure: identifying under nurtured consumers and product segments and concentrating on their needs is key. It is the numbers that confirm these facts.